For Agnès PANNIER-RUNACHER, Minister Delegate to the Minister of Economy, “If companies paid their subcontractors and suppliers on time, it would be 4 billion euros that would go back to middle-sized companies and 16 billion euros to SMEs”. The average payment delay increased from 10 to 13 days between 2019 and 2020. SMEs’ payment arrears jumped from 10.9 to 18.6 days, while large groups stand out with an average payment delay of 8.1 days this year (compared to 8.9 days in 2019).

This loss of profits due to late payments and unpaid payments increases the need for working capital (BFR) for companies, slows down investments and results in a loss of competitiveness, and can also lead to business failure.

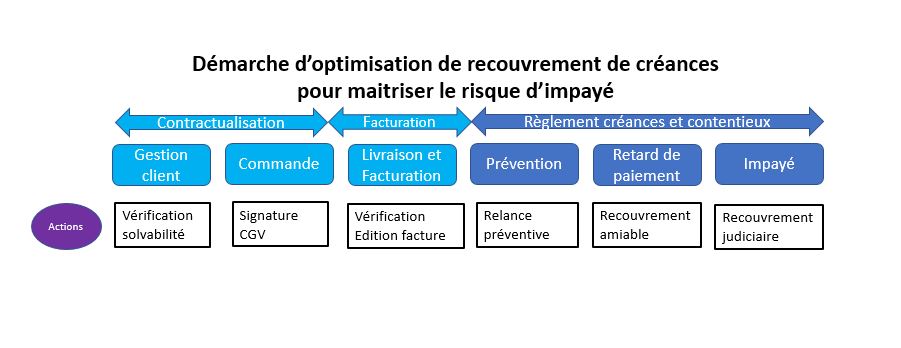

Thus, one or more late payment invoices, or even unpaid ones, can negatively impact the business activity of a company. In the face of such a situation, it is important for the company to put in place step-by-step preventive and curative measures to protect itself from the negative effects of debt settlement and recovery.

The objective of recovery: to obtain payment of invoices at their due date

In terms of recovery, the prevention and speed of processing of any delay in settlement are crucial performance criteria in the control of cash and cash. It is better to prevent than cure. It is important to know that the customer position represents fairly frequently between 35% and 40% of the balance sheet. In this way, it is essential to regularly monitor the payment of invoices to reduce customer and unpaid risks. This point may seem obvious, but experience shows that this follow-up is not always carried out in both small and medium-sized and large enterprises.

In the following sections of this article, we present to you the different forms of debt collection from prevention to court and amicable, in order to obtain payment of his bill.

The objective of the preventive recovery: to reduce payment deadlines to speed up the entry of cash

The preventive stimulus also called pre-contentious aims to remind customers that the expiry of their bill is coming to an end.

Making a preventive recovery five days before the due date of the invoice increases the guarantees of being paid by its customer. It is often a necessary step to reduce payment delays and to get the customer to pay. This approach, often mistakenly considered as time-consuming and inefficient, is a real tool at the service of the credit manager.

It thus allows for the anticipation of any disputes that may lead to late payment and thus avoids litigation. It also validates that the customer has all the elements to achieve the settlement.

Amicable recovery: 90% of unpaid or late invoices are recovered by amicable means

Amicable recovery without legal proceedings means all actions which may be set up in a free manner by the undertaking itself in order to recover the sums due to it through negotiation. It is possible to use gradually:

- The telephone call. This method allows you to have direct contact with the customer and to obtain an immediate response.

- The mail (letter or email) written in courteous terms sometimes allows you to know the reasons for the late payment and to remind the customer of the “forgotten” without offending it.

- The letter of formal notice sent with acknowledgment of receipt with the terms “declaration” and a deadline for payment.

This letter has a real legal value; it is mandatory to be able to apply to the courts. This is the company’s last warning to its client, before moving on to a judicial recovery procedure.

This amicable recovery phase has the merit of showing that the company will not hesitate to bring legal action in the event of a failure to recover. At the same time, it is desirable to refuse new orders from the customer or to impose a cash payment.

Judicial or litigation recovery: in 2019, in civil cases, almost 660,000 litigation proceedings for unpaid claims were opened

Judicial recovery uses the court to recover the unpaid amount, if the amicable procedure has not been successful. The chances of winning a case from a court are dependent on the quality of the claim. Depending on the nature of the claim, several strategies are possible. Either proceed with the judicial procedure of recovery by an order for payment, or proceed with an assignment on the merits or in summary order (we will see in a next article the litigation process).

With the crisis of the Covid-19, delays in payment make the cash flow of companies strained

In a climate where the Covid-19 crisis makes the cash flow of companies tense, failure to comply with payment deadlines endangers the health of economic actors, who can deposit the balance sheet. Thus, in order to safeguard its cash flow, it is imperative to anticipate and reduce payment delays by putting in place preventive and amicable actions in order to optimize its recovery as best as possible while preserving its customer relationship.

Read more

Our support in risk management

Now discover Ellisphere’s expertise on your customer/supplier risk management issues through our dedicated approach.